Type of Accounting and Their Characteristics

Financial accounting vs Managerial account

Financial accounting primarily focuses on preparing the balance sheet, income statement, and cash flow statement—all of which contain historical information. As well as their use by company insiders, these documents are also used by parties external to the company which are the shareholders and creditors.

In order for those parties to compare financial statements from different entities, companies must comply with GAAP (Generally Accepted Accounting Principles). GAAP is a set of rules that standardizes the reporting and recording of companies' financial data. For example, GAAP stipulates that revenue cannot be recognized until a product is delivered to a customer.

Managerial account or cost accounting

Managerial account, also known as cost accounting involves the identification, measurement, analysis, and interpretation of the production, service, and other operating costs of a business. Managerial accounting's focus is in some ways opposite to that of financial accounting. Based on what we know of financial accounting, we can deduce that managerial accounting is for internal use, it does not follow GAAP, includes future projections and often reports on individual divisions and departments.

Differences Between Financial Accounting and Managerial Accounting

| Managerial accounting | Financial accounting |

|---|

| used primarily by internal personnel |

used by company insiders and external parties |

| may present financial statements for individual departments, divisions, products, etc. |

presents overall company financial information in accordance with GAAP |

| may contain future projections |

contains primarily historical information

|

Interestingly, the principles of managerial accounting are all built upon how companies internally account for inventory or service costs. These are costs expended to enhance revenues.

In financial accounting, the total book value of a company's inventory—including raw materials, partially manufactured goods, and finished products—is recorded on the balance sheet with a single figure. Managerial accounting, however, delves into the nitty-gritty of it all.

Manufacturing Cost or Production costs

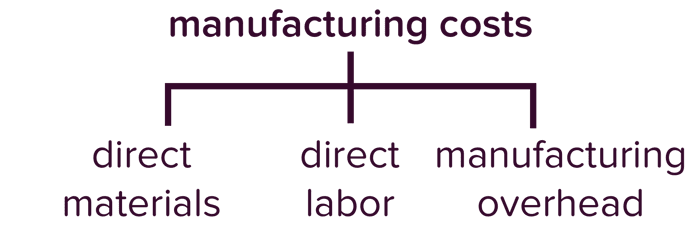

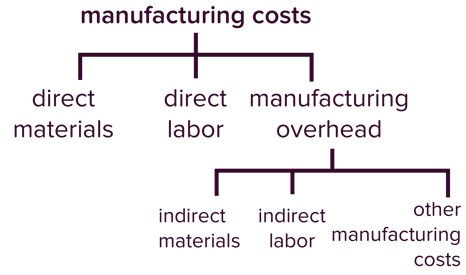

Manufacturing costs, also known as product costs, are all the costs related to the production of goods. They fall into three categories: direct materials, direct labor and manufacturing overhead.

|

| Manufacturing costs |

Categories of Manufacturing Costs: direct materials, direct labor and manufacturing overhead

Direct materials are the raw materials that are physically part of the product being made and are easily identified as such. Little, inexpensive items that are not really worth counting at the individual level, such as nails, are not included.

Direct labor is the work required to assemble the direct materials into the finished products. This includes the cost of the employees specifically working on the manufacturing process. Therefore, the laborer's salary is a direct labor cost, but the production manager's salary is not included.

|

| manufacturing overhead |

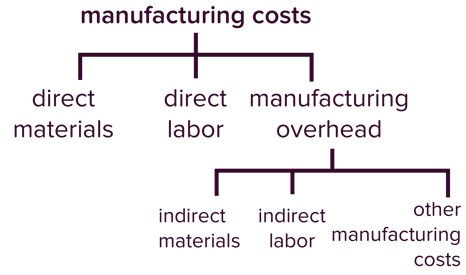

The final manufacturing cost that a company must account for is manufacturing overhead, which consists of indirect material costs, indirect labor costs, and other manufacturing costs.

Categories of manufacturing overhead

Indirect materials include the small items not easily traced to each individual product. Indirect labor includes anyone whose function supports the production process but whose time is not easily assigned to each item of inventory, such as the production manager. Other manufacturing costs include the cost of running the factory which include equipment maintenance, heating for the factory, property taxes and insurance on the factory.

Nonmanufacturing Costs

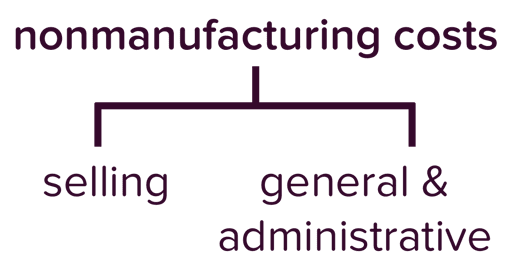

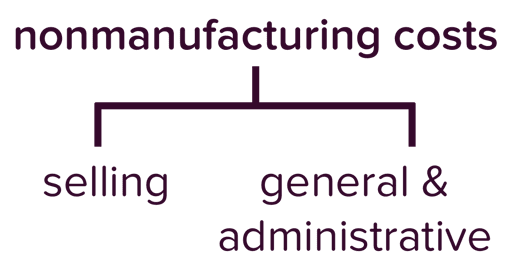

Costs that are unrelated to the manufacturing of goods are nonmanufacturing costs. There are two broad categories of nonmanufacturing costs: selling costs and general and administrative costs.

|

| nonmanufacturing costs |

Selling costs are those associated with marketing, selling, and delivering finished goods to customers. General and administrative costs cover everything that is not a direct cost, manufacturing overhead, or a selling cost, such as executives' salaries and depreciation of office equipment—provided it's not the office of the marketing and sales staff, for example. That would be covered under selling costs.

|

| manufacturing and nonmanufacturing cost |

Summary

Let review the key terms discussed so far.

| Key terms | Definition |

|---|

| Direct material costs | the costs of raw materials |

| Direct labor costs | salaries of manufacturing employees |

| Manufacturing overhead | production costs that are not direct material or labor costs |

| Indirect material costs | costs for materials that are not easily traced to individual products |

| Indirect labor costs | salaries of employees who support production, such as factory supervisors |

| Nonmanufacturing costs | selling, general, and administrative costs |

Good work! We've made great progress learning the terminology of inventory from the managerial accounting perspective. We still have a bit more of it to learn in the next lesson to help make informed decisions.

Post a Comment